微信号

15618884964

来源:聚酯PTA乙二醇短纤投研根据地

Please note that the full English translation is at the end.

在研究石脑油套期保值和加工利润套期保值的过程中,总结归纳了一些关于石脑油的问题。对于石脑油,从未实盘操作过,下面文字如有思虑不周之处,敬请批评指正。

摘要

成品油需求会影响石脑油的供应数量、成本水平、化工下游开工。

化工利润(石脑油→化工品)受成品油利润(原油→成品油)的影响很大;成品油利润与化工利润基本负相关。

成品油利润(原油→成品油)与石脑油利润(原油→石脑油)基本负相关。

石脑油的两个特点

石脑油占油品的份额小

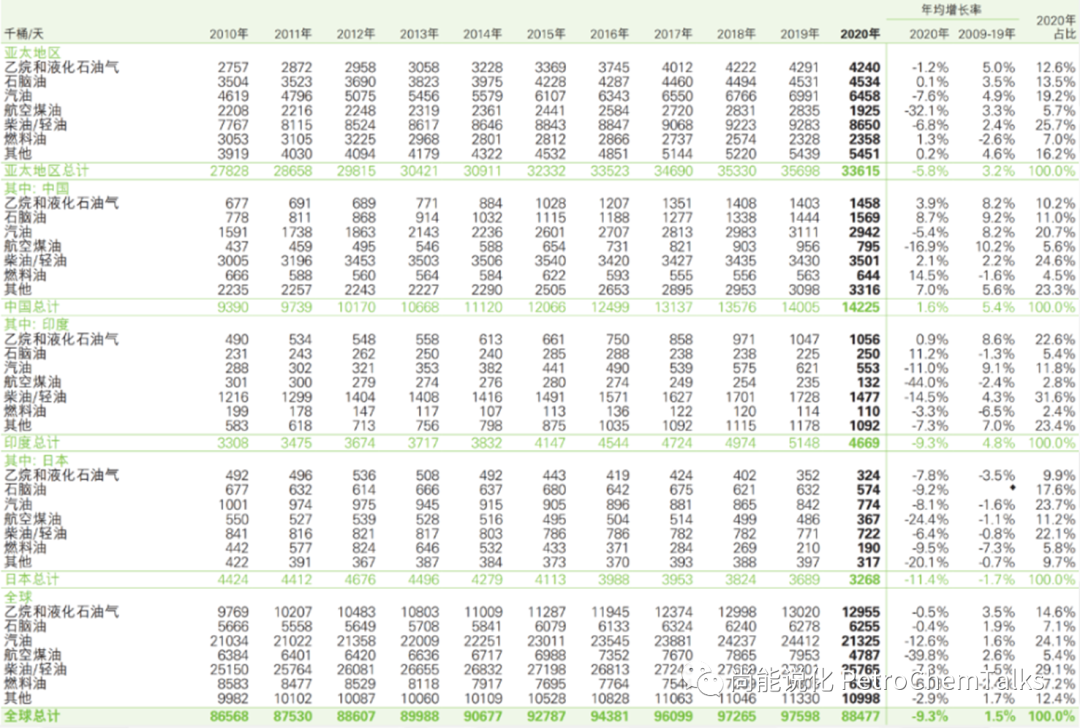

炼油的下游油品中,石脑油的份额小:中国11%,亚太13%,全球7%。而汽柴煤油的一般占比在50%~60%左右。

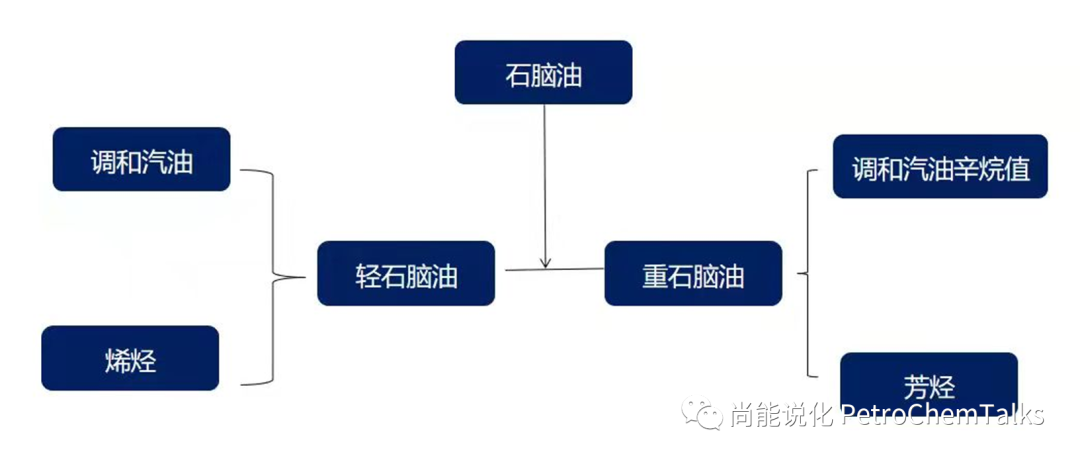

石脑油既能裂解也能调油

石脑油以及其他的一些烷烃和芳烃具有二元性特征:不仅可以作为裂解原料去生产烯烃等化工产品,也可以用于调油(包括炼厂和调油贸易商)去生产汽油等能源产品。

调制汽油的原料

直馏汽油(石脑油、石油醚),轻质石脑油,凝析油(轻烃),精制C5、C9、C10化工油,芳烃150#、200#,混合芳烃,甲醛脂,MTBE, DMC,高碳醇等。

调制柴油的原料

重柴油,蜡油,焦化蜡油,200#以上的溶剂油,重芳烃,C8、C9、C10、C11、C12、C13、C14、C15,航空炼油。灯用煤油,常线油,减一线油,200#、230#、270#芳烃溶剂油,3#矿物油,地炼柴油,裂解柴油,焦化柴油等。

正文

简化起见,先不考虑原油和成品油的供给冲击,只考虑成品油需求(利润)波动造成的成品油价格和加工利润的变化。

1、成品油利润影响石脑油供应:成品油利润对于石脑油供应的影响从两方面展开:排产比例和炼厂总体开工率。

A. 排产比例

成品油利润好,成品油排产比例上升,石脑油排产比例减少,石脑油和调油组分(芳烃类、高烷烃等)会较多地去成品油,都会减少石脑油的供应。

而且,因为石脑油占油品的份额低,所以排产和调油造成的成品油产出比例的小幅调整,比如1~2%,就将造成石脑油供应10~20%的波动。

因此,造成石脑油和其他化工单体原料供应端较大的波动,从而造成它们价格的大幅波动。

成品油通过排产比例影响石脑油的价格,成品油高利润→成品油高排产比例→石脑油低排产比例→石脑油高价格,是正相关的关系。

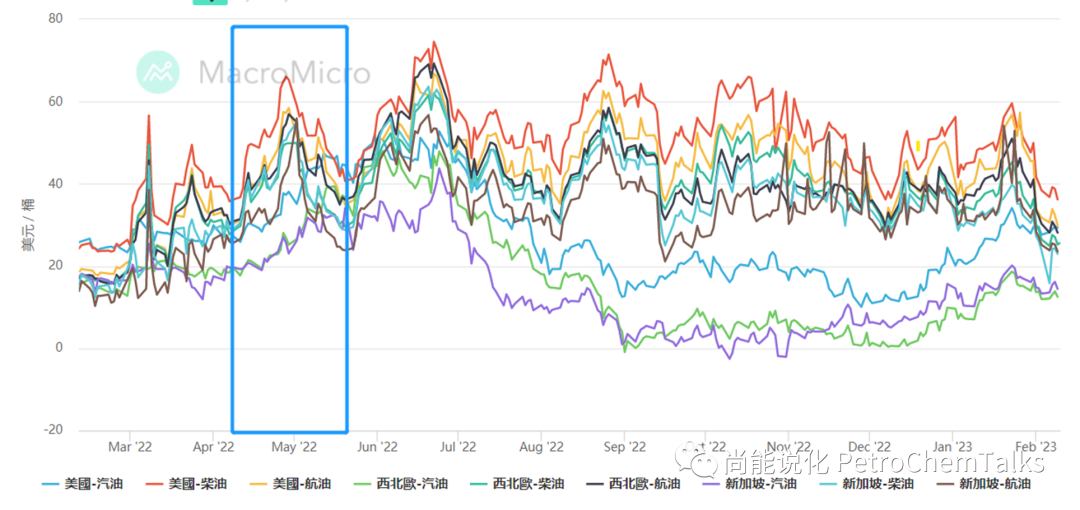

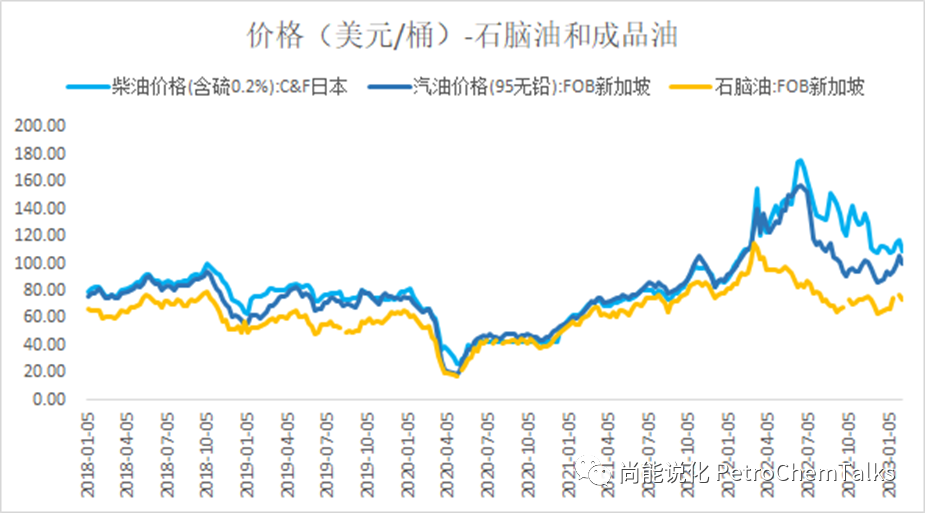

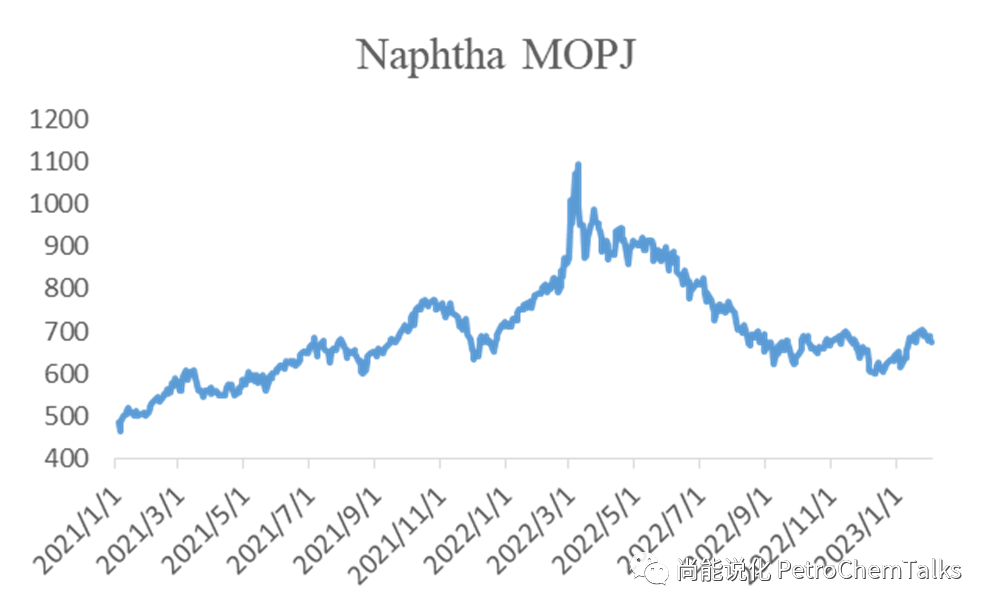

【案例】在2022年5月第一个成品油利润高峰时,石脑油和PTA的价格都达到了年内高位。

B. 炼厂总体开工率

成品油因为占油品的份额高,所以成品油利润的高低又决定着炼厂的总体开工率。成品油利润较好时,炼厂会提高开工率,同样也会增加石脑油的供应。因此,石脑油和其他化工原料的供应增加会相对明显,从而造成石脑油价格降低。

成品油通过炼厂开工负荷影响石脑油的价格,成品油高利润→炼厂高开工率→石脑油高供应→石脑油低价格,又是负相关的关系。

【案例】2022年下半年开始,轻重石脑油价格的劈叉。炼厂的高开工造成轻重石脑油的产量增加,一方面重石脑油的调辛烷值功能和生产的芳烃有调油需求,重石脑油价格持续上涨;另一方面轻石脑油由于产量也同步增加,但是乙烯裂解装置因为经济性原因需求不好,轻石脑油价格降低。

可以将A路径理解为竞争品关系,将B路径理解为副产品关系。至于哪种关系起主要作用,还是要看A和B哪一种路径对石脑油供应造成更多的影响。

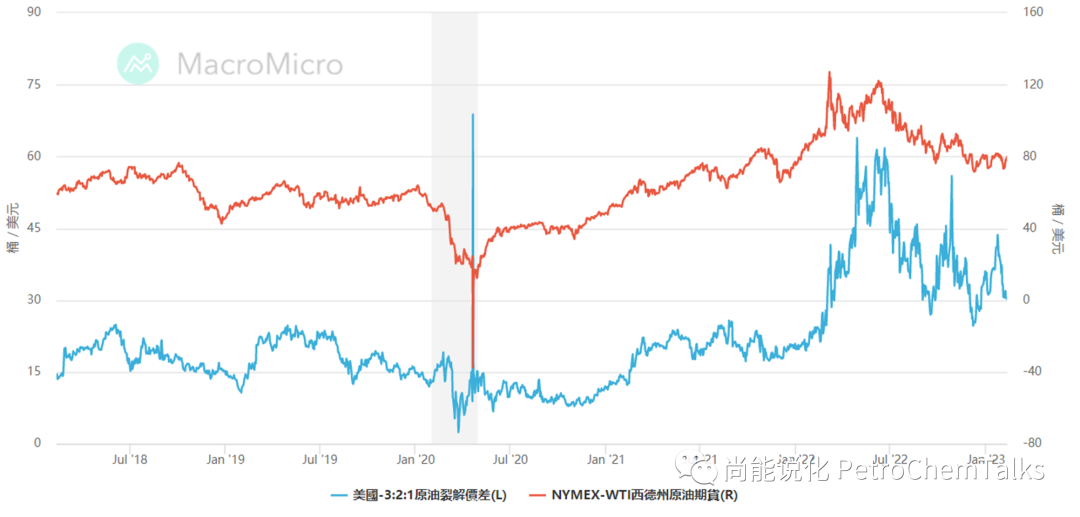

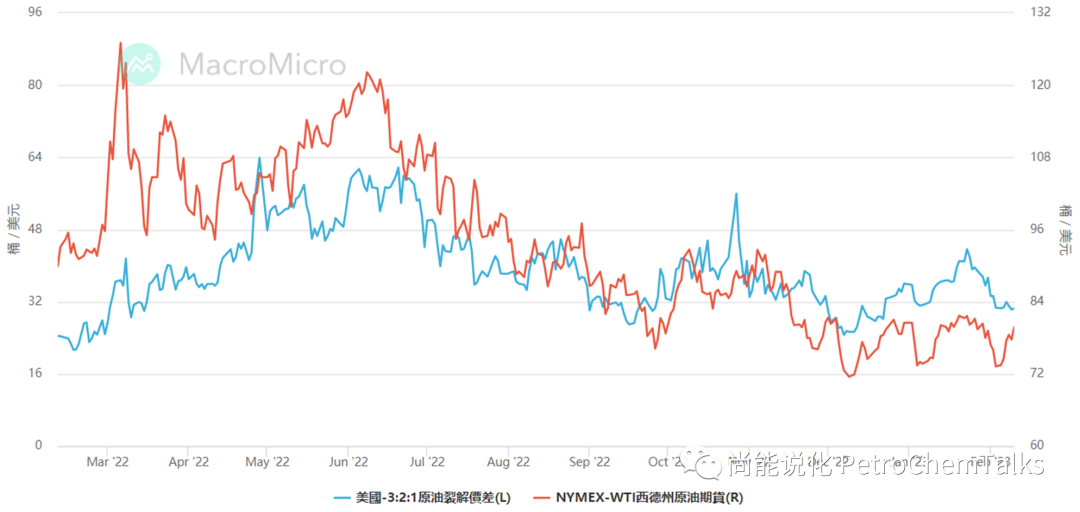

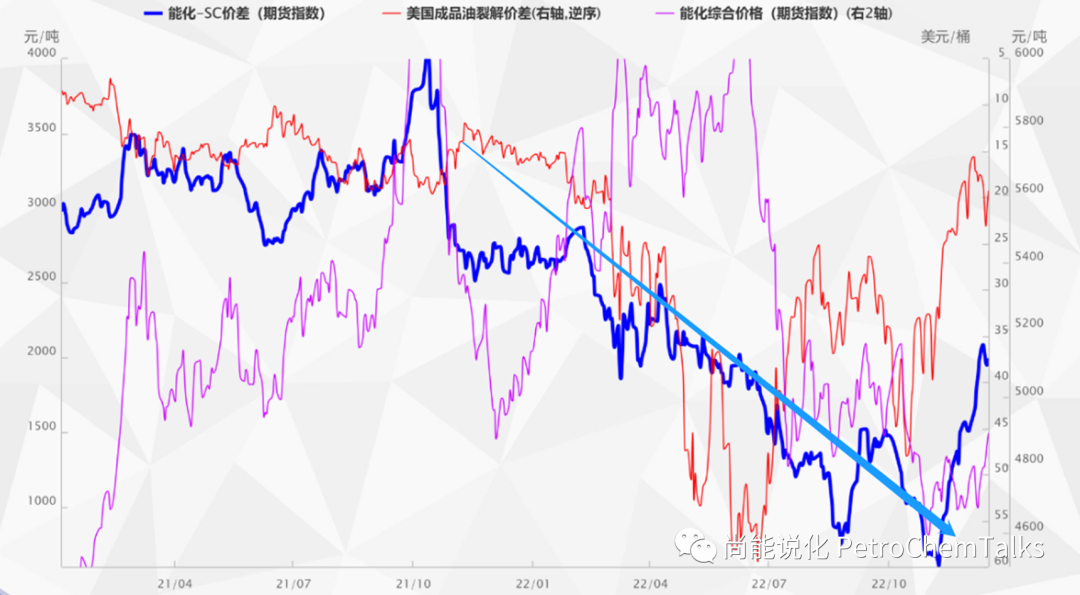

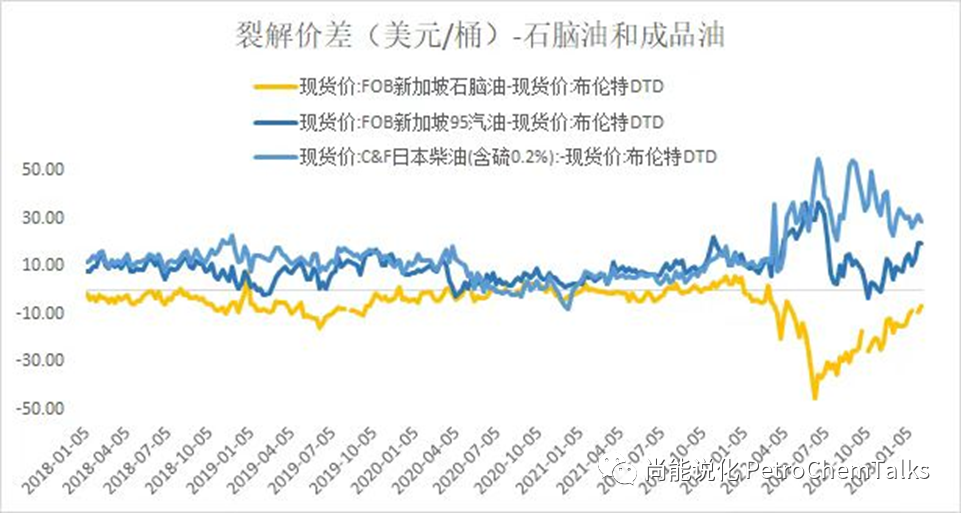

2、成品油利润影响石脑油成本:成品油需求旺盛,利润上升,价格上涨。成品油是原油最主要的下游,当成品油的需求和价格上升,也会导致原油价格上涨。成品油裂解价差(下图红线)与原油价格(下图蓝线)的关系如下,近一年的正相关关系更为明显。而由于成品油裂解价差导致的原油价格上涨同时也会推升石脑油等化工原料的价格。

成品油通过原油需求影响石脑油的价格,成品油高利润→原油需求增加→原油高价格→石脑油高成本,是正相关的关系。

2018-至今

2022-至今

注:传统裂解以3桶WTI原油炼制2桶汽油(RBOB)以及1桶加热用燃油(HO)为基准,传统裂解“价差”=(RBOB 汽油的每桶价格*2+HO热用燃油的每桶价格*1-WTI原油的每桶价格*3。热用燃油可以视作柴油。

从炼油厂预期到实际购买及炼油会有1个月以上的时间差,因此裂解价差通常会领先油价。用油旺季:汽油或燃油库存减少、价格上涨→裂解价差扩大,炼油厂增加原油需求,原油价格上涨。用油淡季:汽油或燃油库存增加、价格下跌→裂解价差收敛,炼油厂减少原油需求,原油价格下跌。

3、成品油下游刚于石脑油下游:成品油需求旺盛,利润上升,价格上涨,石脑油价格跟涨,但是下游对高价的承接能力不一样。成品油对应的下游——能源、出行需求更为刚性,价格承接力更强。石脑油和其他化工原料对应的下游——工业需求相对弹性较大,价格承接力较差。

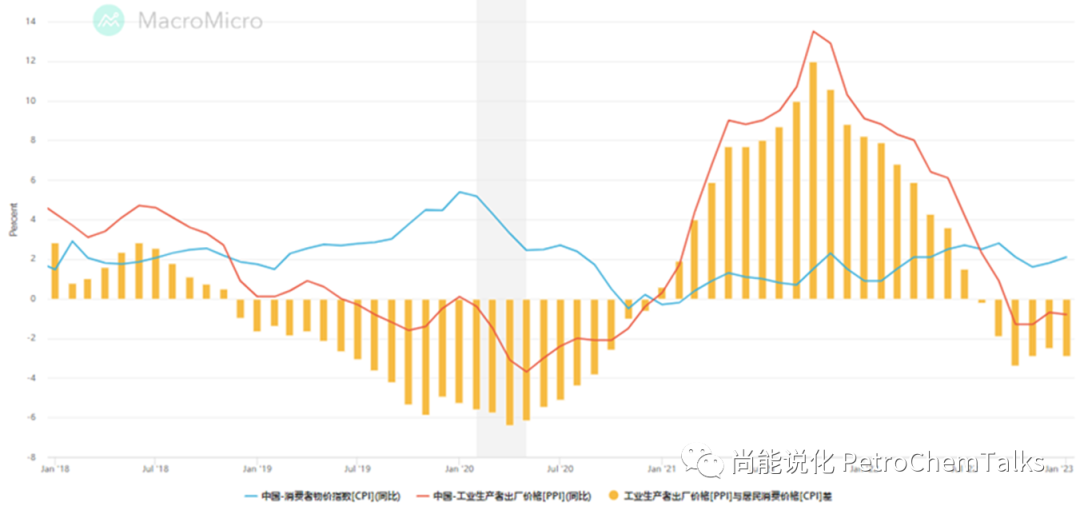

成品油价格波动对应的是CPI,石脑油价格、化工产品价格波动对应的是PPI。PPI(下图红线)相对CPI(下图蓝线)更为波动,因为PPI更多对应企业部门,CPI更多对应居民部门。企业利润扩展或者亏损加剧,会更迅速地往上反馈到对生产原料的需求。同样的,原料成本上升或者下降,也会更容易往下传导到企业的盈亏波动。

因此,石脑油等化工原料的下游需求相对于成品油的下游需求,对价格更为敏感,即原料价格上涨后如果导致总体生产运营亏损,企业更容易通过降低开工率去减少采购需求,从而对石脑油价格进行负反馈。

然而,因为石脑油份占油品的份额小,并且可以由化工转为去调油,所以这种负反馈往上传导到炼厂可以“轻松”地被成品油吸纳,对炼厂的总体开工负荷影响很小。因此,炼厂也不会因为这种负反馈而去调整石脑油价格。相比之下,成品油占油品的份额大得多,并且下游的能源、出行需求更为刚性,所以负反馈的能力和价格承接的能力更强。

所以,我们推测:

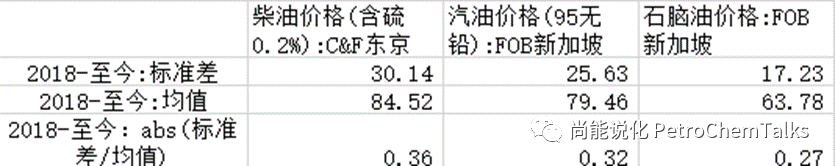

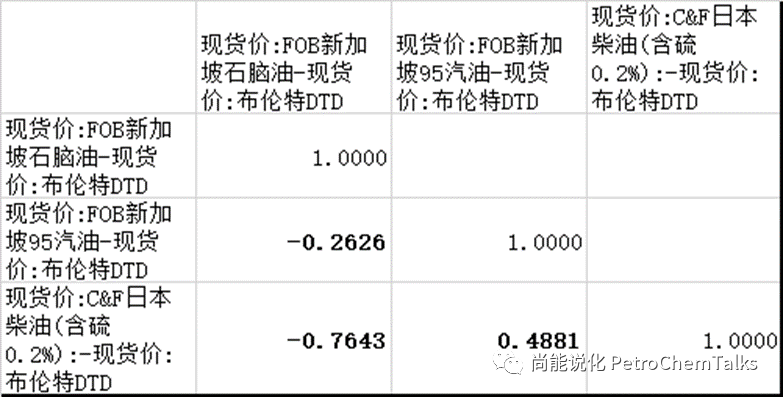

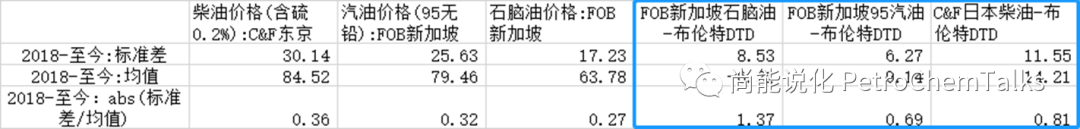

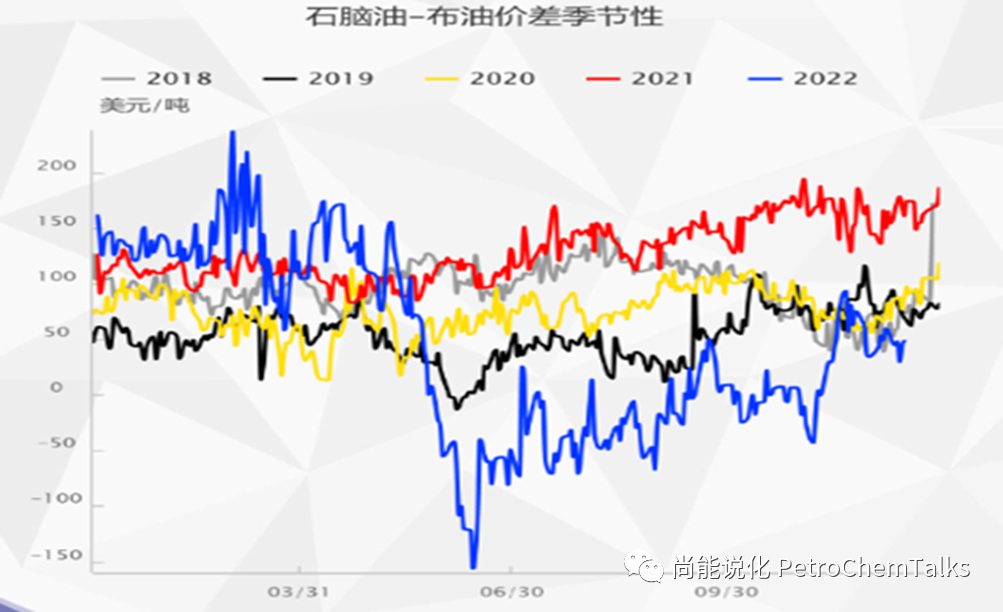

石脑油的价格波动远小于成品油,尤其是石脑油的涨幅远小于成品油。下图的标准差均值比证明了我们的推测。

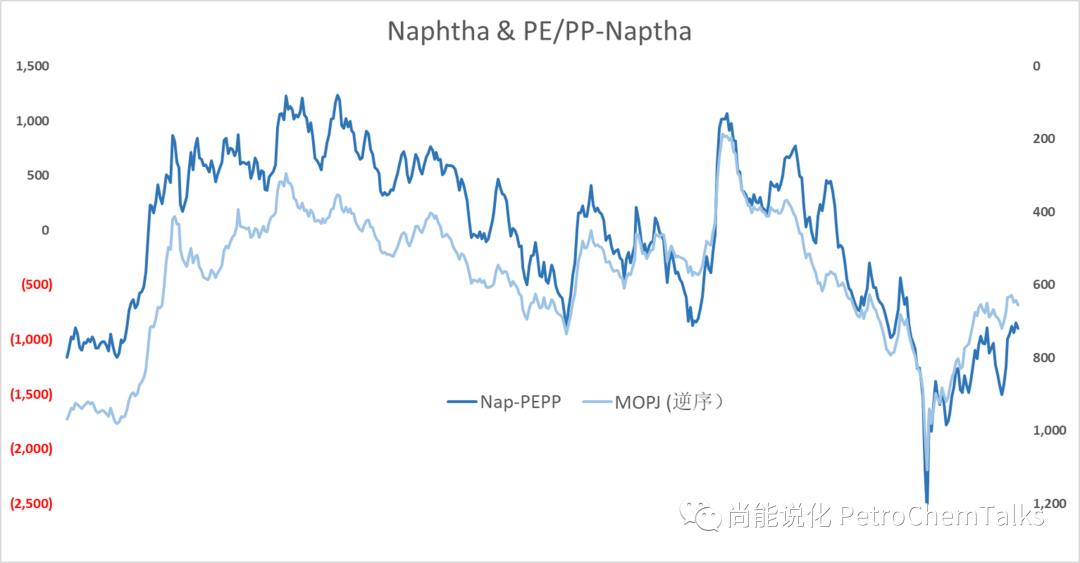

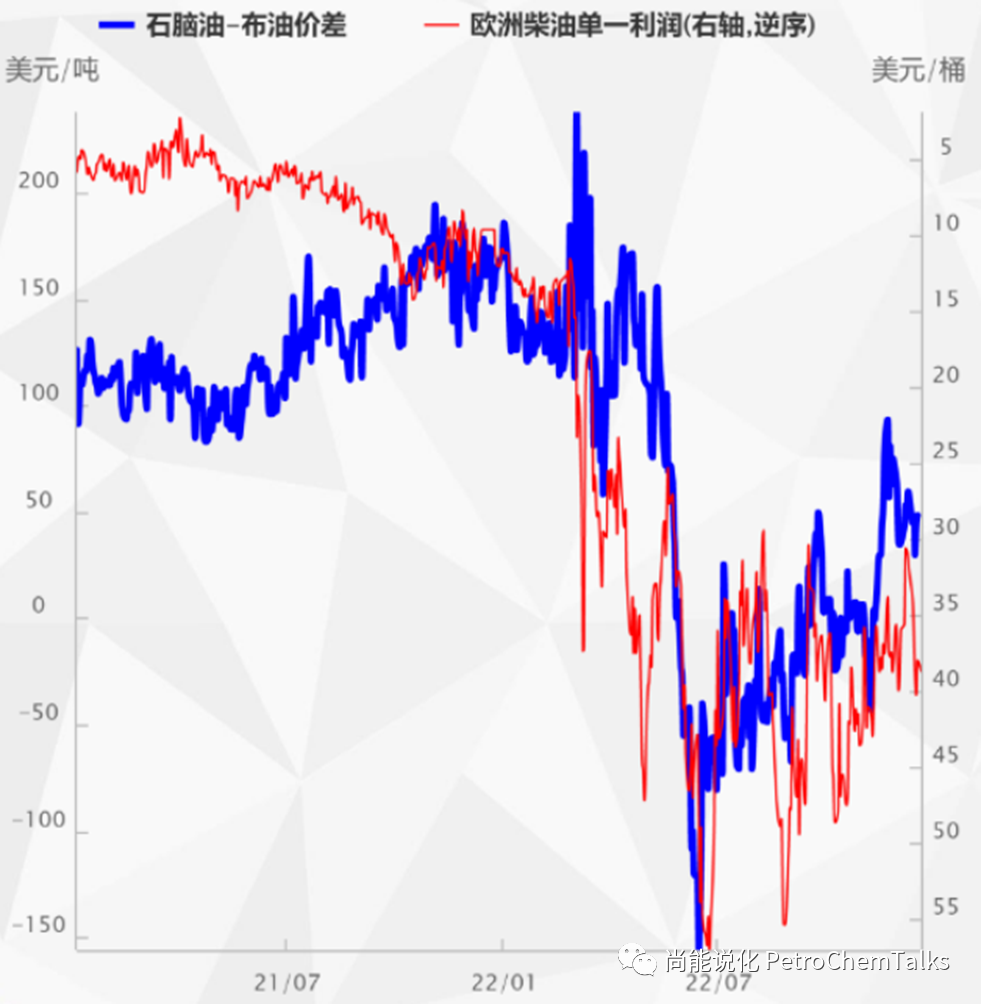

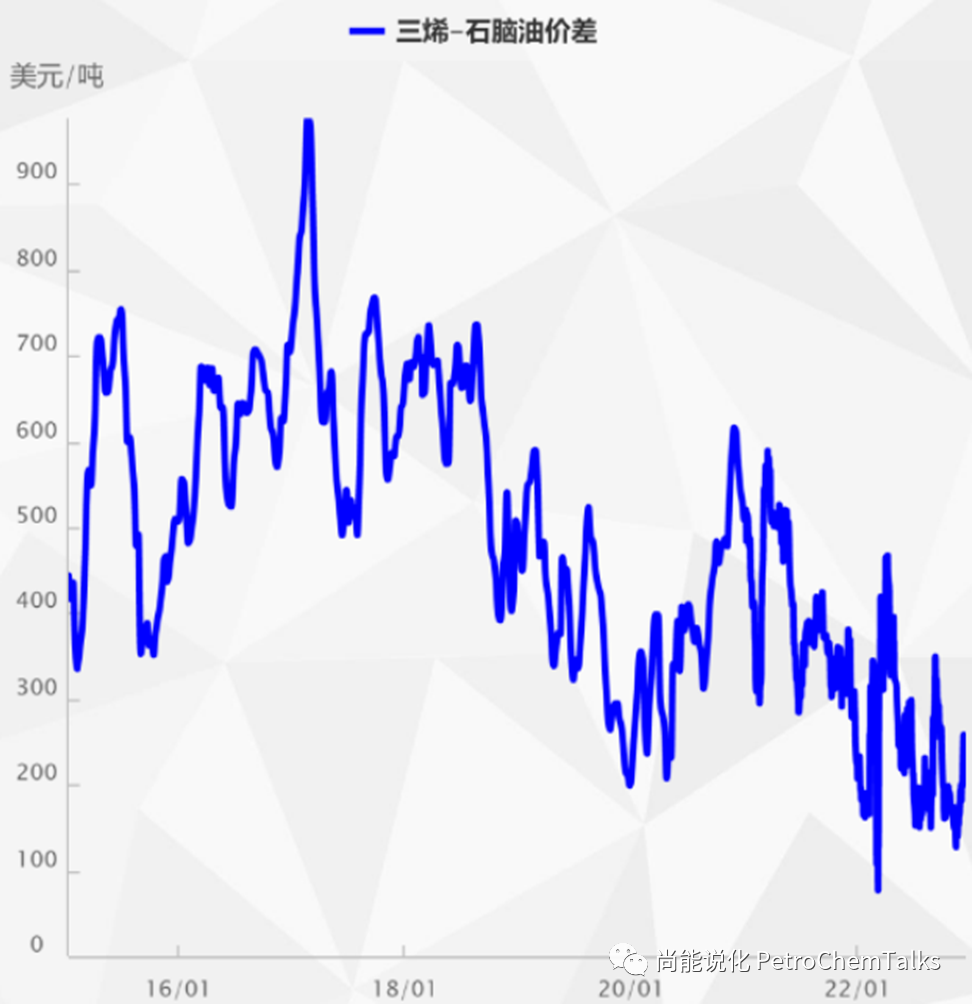

成品油下游对高价的承接力强于石脑油下游,因此成品油加工利润可以较好保持,而化工利润(即化工企业高生产利润)较难保持。下图的化工企业生产利润(以聚烯烃-石脑油为表征)基本和石脑油价格高度负相关。

通过上面的论述,我们可以总结:

成品油需求影响石脑油供应:从排产比例和炼厂开工两个方面一正一负地通过影响石脑油供应去作用到石脑油的价格。

成品油需求影响石脑油成本:成品油裂解利润与油价正相关,与石脑油价格正相关。

成品油需求刚性大于石脑油:成品油价格波动更大,下游需求更为刚性,价格承接力更强。相比之下,石脑油价格波动较小,下游需求弹性较大,价格承接力较弱。

结论

1、成品油利润与化工利润基本呈负相关

成品油利润好、需求好、价格高,导致石脑油价格高,但下游化工品对高价承接力弱,化工利润降低。

也有正相关的时候,比如在2022年三季度,成品油加工利润和化工利润同时下降,主要原因是市场大幅交易加息引起美国衰退和经济硬着陆,以及能源通胀对欧洲产出和需求的压制。

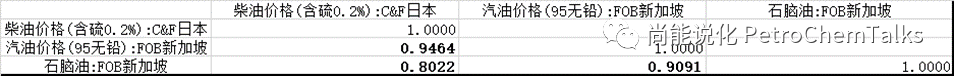

能化-SC近似代替化工利润,因为相对于高波动的原油价格而言,Nap裂解价差是相对稳定的变量,所以用SC代替Nap也合理。Nap=原油+裂解价差,Nap基本由原油的价格和波动决定。

2、成品油利润与石脑油利润基本呈负相关

化工下游化工产品首先进行负反馈,将阻止石脑油价格的上升,进而影响石脑油的加工利润。

如果化工产品的PPI可以成功向下传导到制品的CPI,负反馈会减少,石脑油价格会重拾升势。

如果上游原油向下的成本传导非常剧烈,比如原油因为战争地缘等原因,价格持续上涨,石脑油价格也将被动抬升。

3、炼厂可以承受石脑油较大的加工利润波动

作为小份额副产品的石脑油,炼厂可以“忍受”负的加工利润(类似高硫燃料油)。

2022年的市场表现

成品油需求涨、价格涨、加工利润涨,石脑油价格高

⬇

化工下游基本面需求差,而石脑油价格高,化工原料成本高,化工利润为负

⬇

化工链条负反馈到石脑油,石脑油加工利润与价格同跌

化工链条利润并非只由成本端的石脑油决定,也会受化工品自身供需面影响。

首先,石脑油由于下游负反馈并没有价格大涨,成品油加工利润与石脑油的加工利润以及化工产业利润都呈现负相关。

其次,成品油利润太好,炼厂火力全开,作为“副产品”的石脑油产量也很高, 所以 A.石脑油的供应端相对来说还是较为充分,B.石脑油的需求端化工产品的需求差造成化工品价格低,化工生产利润下滑,化工企业开工降低,造成对石脑油的需求减少。

A和B都造成了石脑油价格下跌,石脑油的绝对价格在2022年跌到了较低位置,相对价格于布油的价差也在季节低位。

“原油—成品油/石脑油—化工品”谁是链上的老大?

在不考虑地缘冲突/原油供给冲击的影响下,总量、价格、利润、波动,还是成品油说了算。

In the process of studying naphtha hedging and processing profit hedging, some problems about naphtha are summarized. For naphtha, it has never been operated in real operation, and if the following text is not thoughtful, please criticize and correct.

Summary

Demand for refined oil products will affect the supply quantity of naphtha, cost level, and downstream start of chemical industry.

Chemical profits (naphtha → chemicals) are greatly affected by refined oil profits (crude oil → refined oil); The profit of refined oil is basically negatively correlated with the profit of chemical industry.

Refined oil profits (crude oil → refined products) are basically negatively correlated with naphtha profits (crude oil → naphtha).

Two characteristics of naphtha

Naphtha accounts for a small share of oil products

The share of naphtha in the downstream oil products of refining is small: 11% in China, 13% in Asia Pacific and 7% globally. The general proportion of gasoline diesel kerosene is about 50%~60%.

Naphtha can both crack and refine oil

Naphtha and some other alkanes and aromatics have binary characteristics: not only can it be used as a cracking raw material to produce chemical products such as olefins, but also for oil blending (including refineries and oil blending traders) to produce energy products such as gasoline.

Raw materials for preparing gasoline

Straight-run gasoline (naphtha, petroleum ether), light naphtha, condensate (light hydrocarbon), refined C5, C9, C10 chemical oil, aromatic hydrocarbon 150#, 200#, mixed aromatic hydrocarbon, formaldehyde lipid, MTBE, DMC, high carbon alcohol, etc.

Raw materials for preparing diesel

Heavy diesel, wax oil, coking wax oil, solvent oil above 200#, heavy aromatics, C8, C9, C10, C11, C12, C13, C14, C15, aviation refining. Kerosene for lamps, constant line oil, minus one line oil, 200#, 230#, 270# aromatic solvent oil, 3# mineral oil, ground refining diesel, pyrolysis diesel, coking diesel, etc.

Body

For the sake of simplification, the supply shock of crude oil and refined oil is not considered, and only the changes in refined oil prices and processing profits caused by fluctuations in refined oil demand (profit) are considered.

1. Refined oil profits affect naphtha supply: The impact of refined oil profits on naphtha supply starts from two aspects: the production ratio and the overall operating rate of refineries.

A. Scheduling ratio

The profit of refined oil is good, the proportion of refined oil production increases, the proportion of naphtha production is reduced, and naphtha and oil blending components (aromatics, high alkanes, etc.) will go to refined oil more, which will reduce the supply of naphtha.

Moreover, because naphtha's share of oil products is low, a small adjustment in the proportion of refined oil output caused by scheduling and oil adjustment, such as 1~2%, will cause a fluctuation of 10~20% in naphtha supply.

As a result, large fluctuations in the supply side of naphtha and other chemical monomer raw materials have occurred, resulting in large fluctuations in their prices.

The high profit of refined oil products→ the high scheduling ratio of refined oil→ the low scheduling ratio of naphtha→ the high price of naphtha, are positively correlated.

【Case】At the first peak of refined oil profit in May 2022, the prices of both naphtha and PTA reached the high level of the year.

B. Overall refinery operating rate

Because refined oil products account for a high share of oil products, the level of refined oil profits determines the overall operating rate of the refinery. When refined oil margins are better, refineries will increase operating rates, which will also increase the supply of naphtha. Therefore, the increase in the supply of naphtha and other chemical raw materials will be relatively obvious, resulting in a decrease in the price of naphtha.

Refined oil products affect the price of naphtha through refinery operating load, and the relationship between high profitability of refined oil products→ high operating rate of → high supply of naphtha → low price of naphtha.

【Case】Starting in the second half of 2022, the price of light and heavy naphtha will split. The high operation of the refinery has led to an increase in the production of light and heavy naphtha, on the one hand, the octane function of heavy naphtha and the aromatic hydrocarbons produced have oil diversion demand, and the price of heavy naphtha continues to rise; On the other hand, the production of light naphtha has also increased simultaneously, but the demand for ethylene crackers is not good due to economic reasons, and the price of light naphtha has decreased.

The A path can be understood as a competitor relationship, and the B path as a by-product relationship. As for which relationship plays a major role, it depends on which path A and B have more impact on naphtha supply.

2. Refined oil profits affect the cost of naphtha: the demand for refined oil products is strong, profits are rising, and prices are rising. Refined oil products are the most important downstream of crude oil, and when the demand and price of refined oil rise, it will also lead to higher crude oil prices. The relationship between the refined oil cracking spread (red line below) and crude oil prices (blue line below) is as follows, and the positive correlation in the past year is more obvious. The rise in crude oil prices due to the cracking spread of refined oil will also push up the price of chemical raw materials such as naphtha.

Refined oil products affect the price of naphtha through crude oil demand, and the high profit of refined oil → the increase in crude oil demand→ the high price of crude oil → the high cost of naphtha are positively correlated.

Note: Traditional cracking is based on 3 barrels of WTI crude oil refining 2 barrels of gasoline (RBOB) and 1 barrel of heating fuel oil (HO), and the traditional cracking "spread" = (price per barrel of RBOB gasoline * 2 + price per barrel of HO hot fuel * price per barrel of 1-WTI crude oil * 3. Hot fuel oil can be thought of as diesel.

There is a time lag of more than 1 month from the time the refinery expects to actually buy and refine, so the crack spread usually leads the oil price. Peak season: Gasoline or fuel oil inventories decrease, prices rise→ cracking spreads widen, refineries increase crude oil demand, and crude oil prices rise. Off-season: Gasoline or fuel oil inventories increase, prices fall→ cracking spreads converge, refineries reduce crude oil demand, and crude oil prices fall.

3. The downstream of refined oil products is just below the downstream of naphtha: the demand for refined oil is strong, profits are rising, prices are rising, and the price of naphtha is rising, but the downstream capacity to undertake high prices is not the same. The downstream - energy and travel demand corresponding to refined oil products is more rigid, and the price acceptance force is stronger. The downstream - industrial demand corresponding to naphtha and other chemical raw materials is relatively elastic, and the price acceptance is poor.

The price fluctuation of refined oil corresponds to CPI, and the price fluctuation of naphtha and chemical products corresponds to PPI. PPI (red line below) is more volatile than CPI (blue line below) because PPI corresponds more to the corporate sector and CPI more to the residential sector. The expansion of corporate profits or the aggravation of losses will more quickly feed back upwards to the demand for production raw materials. Similarly, rising or falling raw material costs will be more easily transmitted downward to the company's profit and loss fluctuations.

Therefore, the downstream demand for chemical raw materials such as naphtha is more sensitive to price than the downstream demand for refined oil, that is, if the price of raw materials rises and leads to overall production and operation losses, it is easier for enterprises to reduce procurement demand by reducing the operating rate, thereby giving negative feedback to the price of naphtha.

However, because naphtha accounts for a small share of oil products, and can be converted from chemical to de-blending, this negative feedback can be transmitted upward to the refinery and can be "easily" absorbed by refined oil, with little impact on the overall operating load of the refinery. Therefore, refiners will not adjust naphtha prices because of this negative feedback. In contrast, refined oil accounts for a much larger share of oil products, and downstream energy and travel demand is more rigid, so the ability to negatively feedback and the ability to undertake prices are stronger.

So, we speculate:

The price volatility of naphtha is much smaller than that of refined oil, and the increase in naphtha in particular is much smaller than that of refined oil. The mean ratio of standard deviations in the figure below proves our conjecture.

The downstream of refined oil products has a stronger bearing force for high prices than the downstream of naphtha, so the profit of refined oil processing can be better maintained, while the profit of chemical products (that is, the high production profit of chemical enterprises) is more difficult to maintain. The production profits of chemical companies in the figure below (characterized by polyolefin-naphtha) are basically highly negatively correlated with naphtha prices.

From the above discussion, we can summarize:

Refined oil demand affects naphtha supply: from the two aspects of scheduling ratio and refinery operation, it affects the price of naphtha.

Refined oil demand affects naphtha costs: refined oil cracking profits are positively correlated with oil prices and positively correlated with naphtha prices.

The demand for refined oil is more rigid than naphtha: the price of refined oil fluctuates greater, the downstream demand is more rigid, and the price acceptance is stronger. In contrast, the price of naphtha is less volatile, the downstream demand elasticity is large, and the price carrying force is weak.

Conclusion

1. The profit of refined oil and the profit of chemical industry are basically negatively correlated

The profit of refined oil products is good, the demand is good, and the price is high, resulting in high naphtha prices, but the downstream chemicals have a weak ability to undertake high prices, and chemical profits are reduced.

There are also positive correlation times, such as in the third quarter of 2022, when refined oil processing profits and chemical profits fell at the same time, mainly due to the recession and economic hard landing in the United States caused by sharp market trading rate hikes, as well as the suppression of European output and demand by energy inflation.

Energical-SC approximates the replacement of chemical profits, because the Napp cracking spread is a relatively stable variable relative to highly volatile crude oil prices, so it is reasonable to replace Nap with SC. NAP = crude oil + cracking spread, Nap is basically determined by the price and volatility of crude oil.

2. The profit of refined oil and the profit of naphtha are basically negatively correlated

The first negative feedback of chemical downstream chemical products will prevent the rise in the price of naphtha, which in turn will affect the processing profit of naphtha.

If the PPI of chemical products can be successfully transmitted down to the CPI of products, the negative feedback will be reduced and the price of naphtha will resume its upward trend.

If the downstream cost transmission of crude oil is very violent, such as the price of crude oil due to war geography, etc., the price of naphtha will also rise passively.

3. The refinery can withstand large fluctuations in the processing profit of naphtha

As a small share of naphtha, a byproduct, refiners can "endure" negative processing margins (similar to high-sulfur fuel oil).

Market performance in 2022

Demand for refined oil products has risen, prices have risen, processing profits have risen, and naphtha prices are high

⬇

The fundamental demand for chemical downstream is poor, while the price of naphtha is high, the cost of chemical raw materials is high, and the chemical profit is negative

⬇

The chemical chain negatively fed back to naphtha, and the profit of naphtha processing fell with the price

The profit of the chemical chain is not only determined by the cost of naphtha, but also by the supply and demand side of the chemical itself.

First of all, the price of naphtha did not rise sharply due to negative feedback downstream, and the processing profit of refined oil was negatively correlated with the processing profit of naphtha and the profit of the chemical industry.

Secondly, the profit of refined oil is too good, the refinery is full of firepower, and the production of naphtha as a "by-product" is also very high, so A. the supply side of naphtha is relatively sufficient, B. the demand for naphtha demand side of chemical products is poor, the price of chemical products is low, chemical production profits are declining, chemical enterprises are operating down, resulting in a decrease in demand for naphtha.

Both A and B contributed to the decline in naphtha prices, with the absolute price of naphtha falling to a lower level in 2022, and the relative price spread to cloth oil also at a seasonal low.

"Crude oil - refined oil / naphtha-chemicals" Who is the boss in the chain?

Without considering the impact of geopolitical conflicts/crude oil supply shocks, the total volume, price, profit, and fluctuation are affected by the refined oil.

微信号

15618884964